February was our first month to go all out on budgeting. We've had budgets on-and-off for the past three years or so, and I've had budgets since undergrad, BUT....sticking to the budget is another story. Now that we've made it our mission to find financial peace, I want to start sharing more with you about that journey.

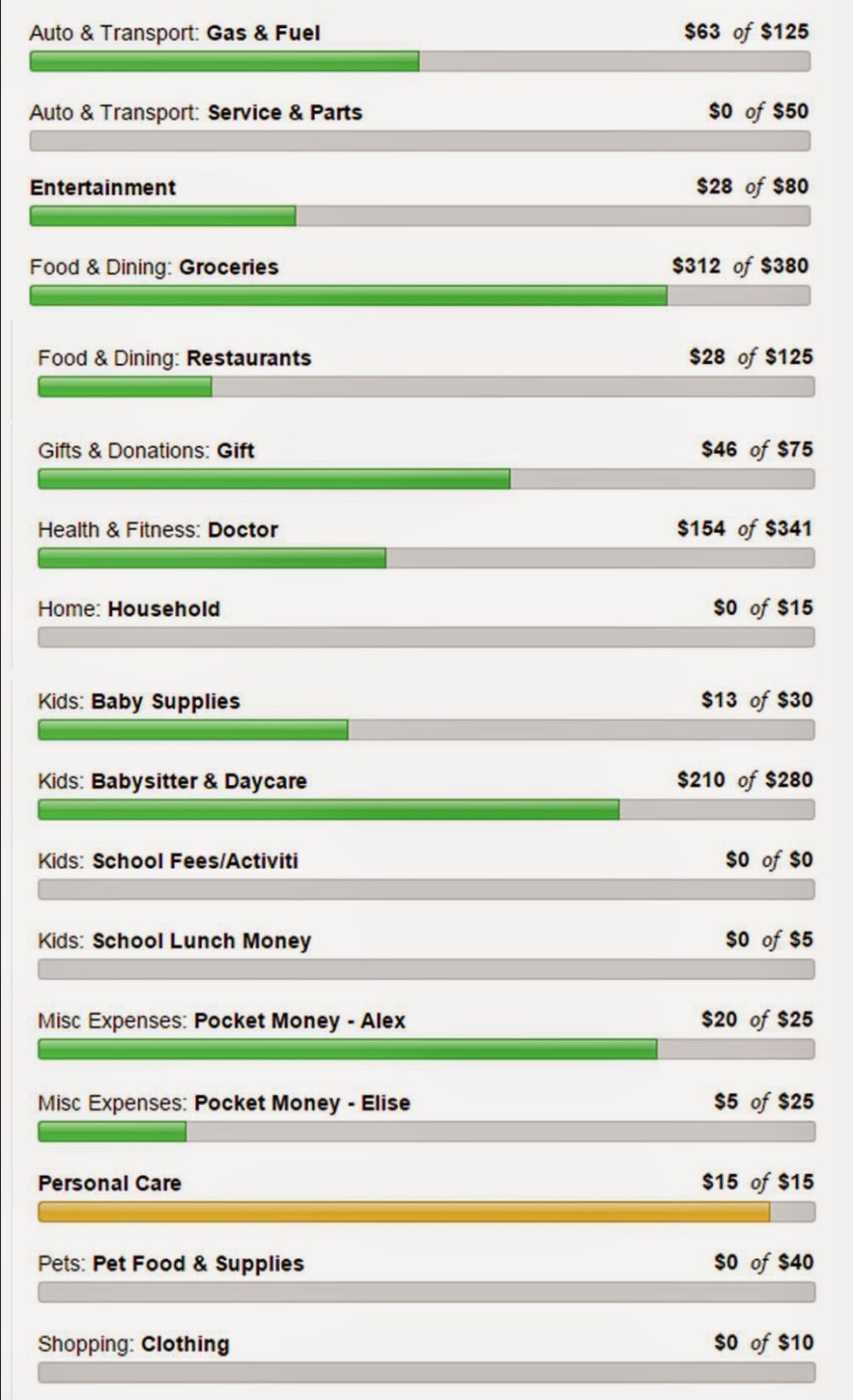

It's mid-February and there are some areas we've done really well in and others that we haven't done as well in, so let's have a look.

We have many of our bills already set up to automatically debit from our checking account, which is very convenient and helps cut down and save money on potential late fees in case we get a check in the mail a day late. Our automatic debits include: utilities (gas and electric), internet, cell phones, car insurance, tithe, and even rent.

For our variable expenses (i.e. expenses that are not the exact same amount every month), we are working to move towards using cash as much as possible. Yes, cash envelopes, just like Dave Ramsey recommends.

Here's where we stand (not including automatic debit items and a few other budget items:

|

| By the way, I love Mint.com for keeping track of our budget! |

Not shown here is also our budgeted savings/debt snowball goal of at least $1,000. And putting $1,000 into a savings/debt snowball fund is a big deal for us, honestly. We've budgeted and been cheap, but never really quantified a savings goal before. And like many people, sometimes I would look at things and wondered where I had gone wrong that month.

I wasn't completely crazy about going the Dave Ramsey way. Don't get me wrong; he certainly has some extremely good advice, there were just a few things I wasn't sure about. (Like cash envelopes.) Well, we have 10 days left in the month, and I think that we just might come in under budget. Groceries are going to be tight, but thanks to a customer service error last weekend, we scored an extra extra large pizza for only $3 that fed 5 people! So, we will have plenty of extra in our restaurant envelope if I need to adjust for groceries.

So far, I would have to say that we are on track towards finding financial peace. You can read more about why we wanted to take control of our finances in my prior post.

I hope you'll stick with me as we continue to muddle through our mission to financial freedom!

.jpg)

No comments:

Post a Comment