Thanks for joining us on our

Mission to Financial Freedom! Over the past week, I've been able to find some fantastic Weekly Wallet Wins to help keep our spending down, stockpile up, and

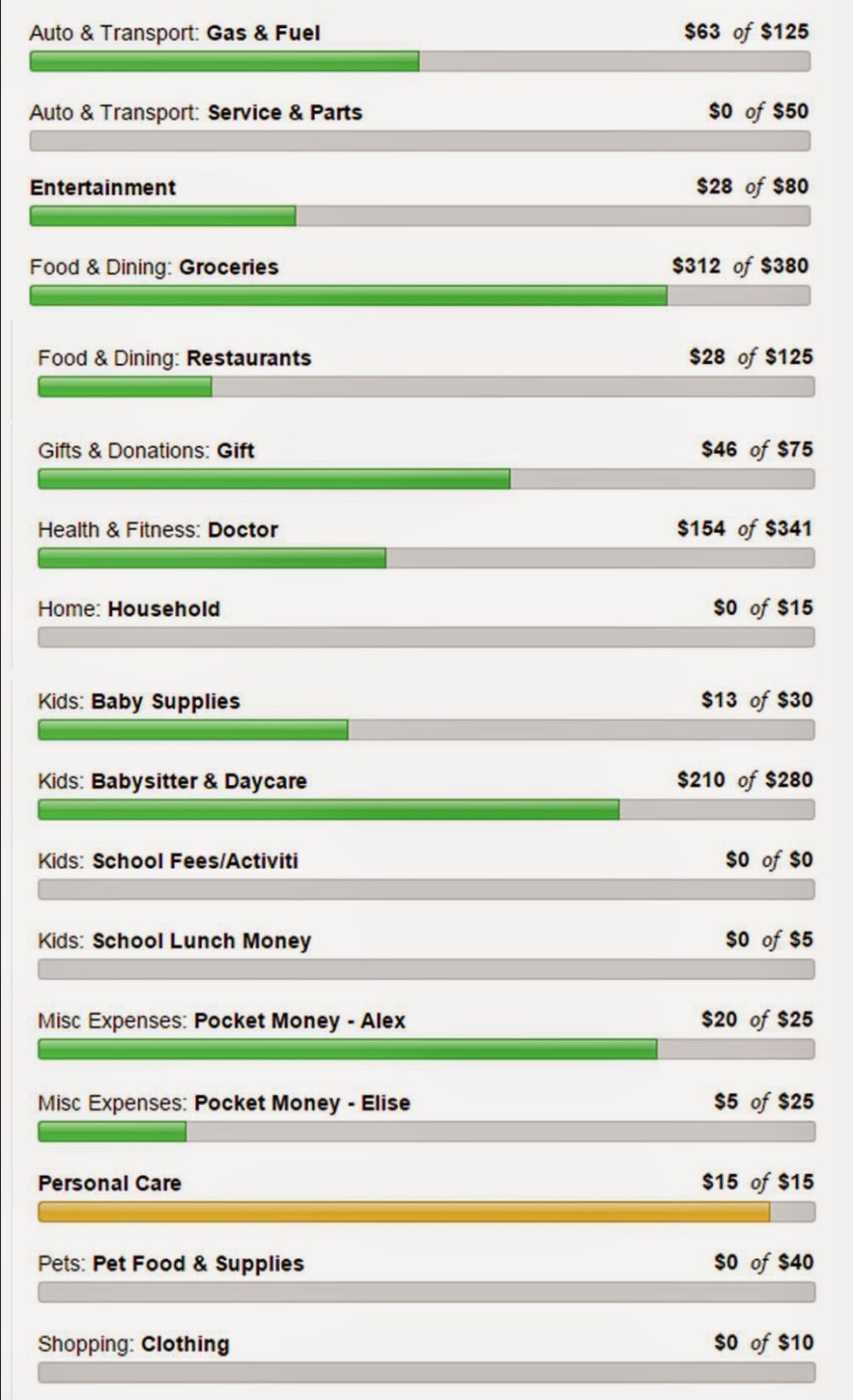

budget on track!

For the Little Ones

23 Clothing Items = $2.14

My favorite used kids' clothes store has their clearance on sale right now -- 10 items for $1. It's seriously almost like free clothes. I got a bunch of clothes awhile back when it was priced at twenty-five cents per item, but this is even better despite the smaller selection. I may have to go back and pick up a few more things tomorrow. It breaks down like this: Little Miss Harvey - 19 items (3 two-piece outfits, X shirts/onsies, X pants), Baby Prez - 2 shirts, Miss Coco - 1 pants.

CVS Deal on 2 Packages of Huggies Diapers + 2 Huggies Wipes = $10.50

CVS Sale: 2 Huggies Jumbo Packs for $18

Spend $20, Get $5 ExtraBucks

Transaction 1:

1 Jumbo Pack Huggies Snug & Dry $9

1 Huggies Wipes $3

used $2/10 Huggies purchase CVS coupon

used $4 ExtraBucks from last week

= $9 + 3 - $2 - $.50 - $2 - $4 = $3.50

Transaction 2:

1 Jumbo Pack Huggies Pull-Ups $9

1 Huggies Wipes $3

used $2/10 Huggies purchase CVS coupon

= $9 + 3 - $2.50 - $.50 - $2 = $7

Received $5 Extra Bucks

Total Spent on Diapers & Wipes = $10.50 or $2.63 per item

Saved $21.06 off regular price, 67% savings

For Mommy

Maternity Clothes = $30

I've been dreading getting out my maternity clothes because, well, some of them are just ugly. So instead of spending insane amounts of money at

Motherhood Maternity (even though they have the cutest clothes), I checked out Craigslist and found the nicest person who was selling a three big lots maternity clothes lots. She let me pick through and pick out what I wanted, and I found a few pairs of dress pants and leggings and 10 or so tops! I think I averaged close to

$2 per item!

CVS Deal on 2 boxes of Natural Instincts Hair Dye = $4.34

CVS Sale: 2 boxes for $12

used $5 Extrabucks from diaper transactions above

= $12 - $3 - $5 + tax = $4.34 or $2.17 per box!

For Our Tummies

14 lbs Bananas = $.26/lb

1 bite-sized Ben & Jerry's = $0.00

Last Friday, I also took advantage of the

Saving Star weekend 100% back deal!

Broccoli

This Friday (today), I will be taking advantage of a sale at HyVee combined with this week's healthy

Saving Star deal (

20% back on broccoli). I can't wait to find out what the weekend deal will be for 100% back.

XXL Pizza = $3

Last weekend, Miss Coco wasn't sure where she wanted to eat for her birthday dinner, but she wanted something spicy, so we ended up ordering a spicy chicken pizza, which is a local specialty at

Lazarri's in downtown Lincoln. When we arrived to pick up the pizza, the employees had not even begun to make it yet...they just forgot that they were supposed to be making pizza, apparently. Despite the mistake and having to wait for them to make the pizza, we then got a huge discount and paid $3 instead of about $23!

$3 to feed 5 people...that's my kind of meal!

Extra Income

I just started using

Ebates over Christmas for my online shopping. The first quarterly check came in this week! I love that

Ebates is free, and that I can get real cash back!

New Tutoring Clients = $?.??

My husbands tutoring business is really growing this month, so he has more tutors and more students than ever before. I don't have exact tallies on how much extra money he will bring in beyond what we budgeted, but I'm excited to put that extra money towards our debt snowball fun. \

Extra Teaching = $?.??

In my department, we just had a professor leave unexpectedly for what we think will be the rest of the semester, so I'm taking over one of his classes and will paid over $1,000 more each month than usual. However, I don't know when I will actually start seeing the paycheck

Did you have any wallet wins this week?

Read more about our Mission to Financial Freedom HERE.

Follow Elise Harvey {Harvey Ever After}'s board Money Matters on Pinterest.

Follow Elise Harvey {Harvey Ever After}'s board Money Matters on Pinterest.

.jpg)